Key finding

More needed to power the growth of renewables.

Companies must increase the capacity of renewables in their generation mix. Despite the fast-improving economics of renewables, technological advances and favourable policy landscapes in certain markets, only some companies are switching fossil fuels for renewables.

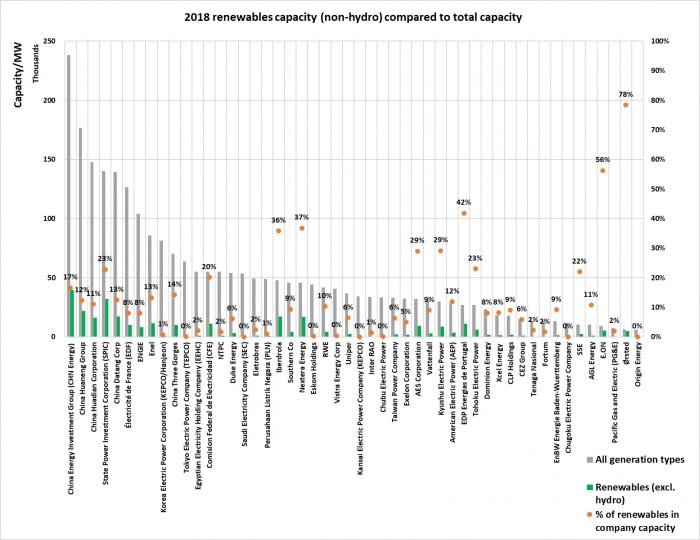

The very limited remaining emissions budget means it is imperative that the biggest emitters decarbonise swiftly and deeply. Yet the generation mix points to continued fossil fuel dependency: 60% of the 2018 installed capacity across the 50 companies used coal, gas and oil. Excluding hydro power, just 12% of 2018 capacity was from renewables.

Companies must increase the proportion of renewables in their generation mix or radically speed up deployment of low-carbon alternatives.

The rate of renewable energy adoption varies greatly across the companies. The bar chart below shows which companies have the most (non-hydro) renewable capacity in their mix – in absolute terms and as a proportion of their total mix.

Despite having the highest absolute renewable capacity in the sample, CHN Energy has a very poor ACT rating (1.3E-). More than 75% of the company’s 2018 generation capacity was from coal. CHN has no transition plan and has not committed to public and verifiable emissions reduction targets. Analysis showed little evidence to suggest that the company is taking any measures to reduce emissions or prepare for a low-carbon economy.

Fortunately, the economics of renewables is improving fast. IRENA recently reported that in many regions renewable technologies are already cheaper than new fossil fuel capacity and compete well against existing capacity. Also, in some regions, policy levers such as carbon pricing – where regulators put a price on carbon through an emissions trading scheme or carbon tax – are supporting a shift to renewables.

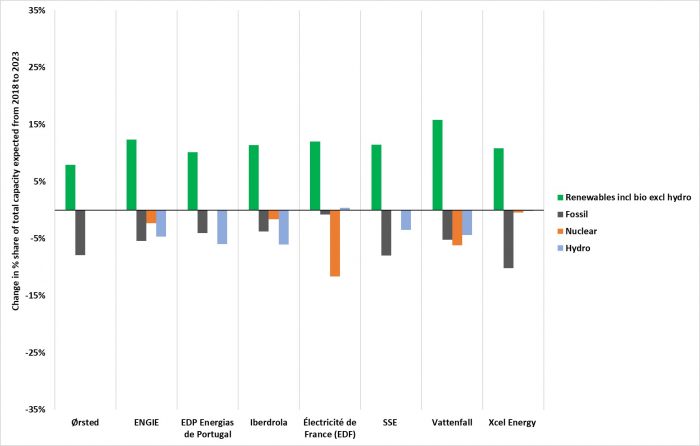

Data available on current and expected generating assets suggests that some companies are growing the share of renewables in their mix far more quickly than others. The chart below shows how the generation mix is predicted to change at the eight highest performing companies. All are expected to increase their share of renewables – in most cases replacing fossil fuel share.